Sport. It’s the lifeblood of Kiwi culture; we watch it, we play it, we talk about it, and we love companies that support New Zealand sport. In fact, 35% of New Zealanders feel positive about companies that sponsor events.

But just like we’d disown a family member who supported anyone but the All Blacks in the World Cup, our sensitivities also mean brands need to understand who, how, when, what and why we’re engaging with sport and sport related content in order to achieve real cut through.

The Oxford Dictionary defines sport as: An activity involving physical exertion and skill in which an individual or team competes against another or others for entertainment. You could say the media and marketing industry is doing just that, and the consumer is the ball. A successful game strategy relies on understanding the rules.

The goal posts are clear; it’s about reaching the right audience and creating a response and connection with them that is strong enough to drive a positive reaction.

KNOW THE MARKET, IT’S CHANGED

We’re increasingly spoilt for choice. There’s infinite new ways of accessing sports, news content and live events (both local and world sport). This choice and availability, combined with a consumer’s limited time places pressure on the participation and consumption of sports. Participation rates are down marginally and attendance levels have taken a hit over the last five years.

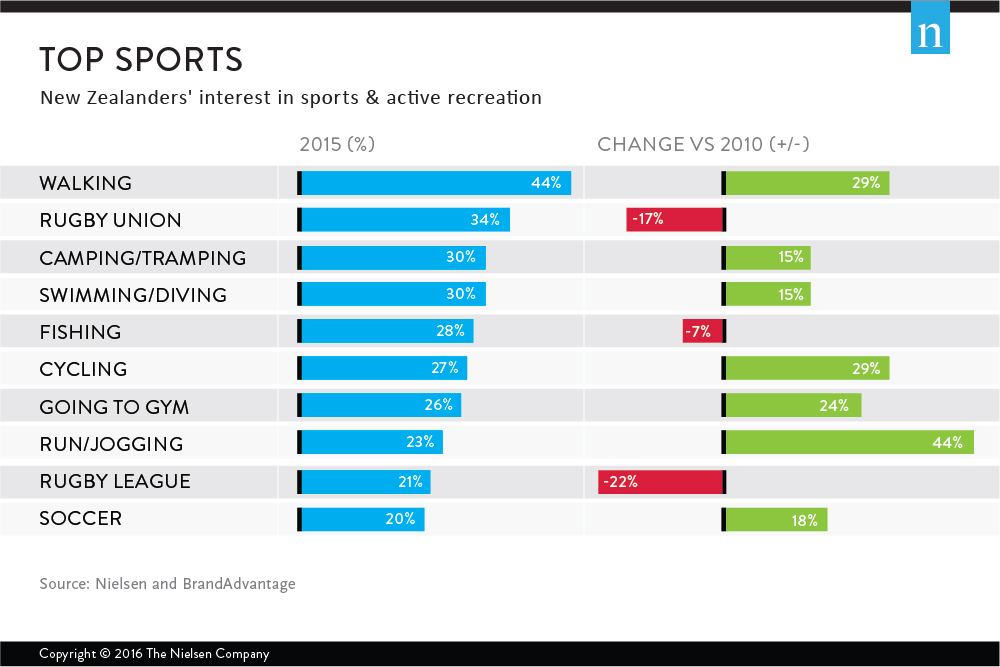

New Zealanders have moved away from some traditional team and individual sports towards a personal focus on health and wellbeing. Walking now occupies the number one sports and active recreation spot having seen +29% growth since 2010. Rugby Union is now in second place, -17% since 2010 and camping/tramping third, increasing by 13%. Cycling, going to the gym and running have all seen growth in interest. Soccer is the big winner in traditional sports with 18% growth in the last five years. Rugby league has seen the sharpest decline (-22%). Car racing and netball have also declined and now are no longer ranked in the top 10.

Does this mean New Zealanders love affair with major sports is over? No, it’s a reflection of changes in personal priorities, and that supporters crossover their interests into many sports. Opportunities exist for sponsors, businesses and governing bodies to further commercialise Kiwi sports passion. In fact, BrandAdvantage estimates its value between $280-$350 million per year.

SEGMENTATION IS KEY

87 per cent of us say we’re interested in sport, so the fan base is big, but our drivers for engagement differ wildly.

Deep segmentation into demographics, locality, preferred teams, attitudes to sport and levels of fandom will offer more insight and information than just audience figures provide.

TV REMAINS THE FRONT RUNNER

TV is the key driver of sporting engagement in New Zealand, around two in five keep up to date with sports on TV. The Rugby World Cup final was the second most watched television programme in 2015 (after One News) with an average audience of 673,000. Rugby dominates the broadcast sports coverage, and almost three quarters (72%) of us having watched a live rugby game on TV in the past 12 months.

…BUT IT’S A CLOSE RACE

39% of Kiwis use newspapers to get information and generally engage with sports they are interested in. Just under one-third (32%) use Facebook for this purpose and around a quarter listen to the radio (26%).

1.5 million New Zealanders visited a sport website in February 2016. Seven out of the top ten sites saw growth since February last year. A couple reached audiences of over half a million people in a month, including the first ranked site, stuff.co.nz with an audience of 669,000*. The TVNZ sports site grew by 87%, MSN sports by 82% and NZ Herald sports by 51%.

BUILD ONLINE

Options to ‘watch the game’ have never been greater and sports fans have higher incidence of usage and ownership of devices of the general population. Seven out of ten sports fans use a smartphone and one-in-three own a tablet.

As the creation and distribution of mobile-first sport video content grows, publishers are developing more convenient and streamlined options for mobile sport video viewing. Live streaming and short-form content designed for mobile consumption are all trends that are gaining momentum in the U.S. and are poised to emerge locally.

GET SOCIAL

Online engagement among New Zealanders is skyrocketing, and sport content is one of the major growth verticals. There’s an appetite to read articles, reviews and look at photos online. Apps are a great platform for engagement. CricHQ is good example of adding value for Cricket enthusiasts, providing content and the ability to view anywhere and anytime.

We are increasingly seeing engagement strategies shift from a one-to-many approach to a one-to-one approach. This engagement allows fans to get much closer to their sporting heroes. Of social media users, 17% have connected with a sports team, brand or event.

HARNESS SPORTS STAR POWER

Sports stars thrill and influence audiences globally. Correctly engaged with a brand they can drive new growth in sales, retain customers, engage and build trade relationships, and enhance supplier and stakeholder value.

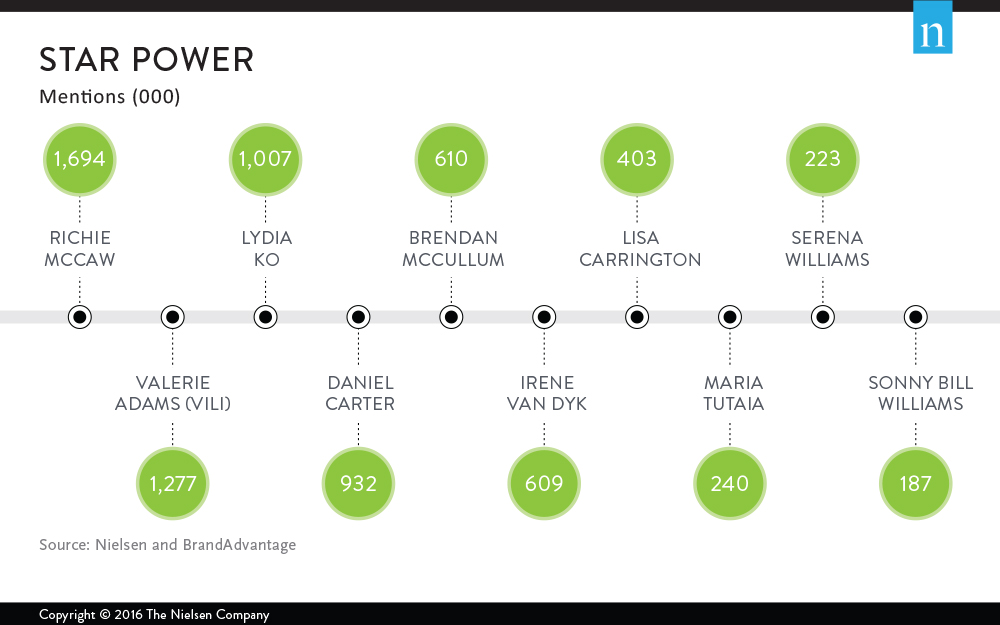

Richie McCaw is New Zealand’s overall number one sports person by some distance from Valerie Adams and Lydia Ko. Only these top three achieved more than 1 million unprompted mentions. Dan Carter, Bendon McCullum and Irene Van Dyk gained more than half a million mentions.

THE END GAME

With sports sponsorship remaining one of the most competitive spaces in the industry, both publishers and brands need to understand the changing sports fan with more detail than ever.

It’s about connecting who is watching, with what this audience is buying. This means finding an exact audience and using ad spend more effectively to get a result. With more than ten major spectator sports, increasing international sports broadcast, and at least four screens to engage across, you begin to understand how essential it is to understand your audience more clearly.

Purchase and download the report here.

*Source: Nielsen Online Ratings, average unique audience March 2014-Feb 2016.

ABOUT THE NIELSEN AND BRANDADVANTAGE NEW ZEALAND SPORTS, ARTS AND ENTERTAINMENT REPORT

The Sports, Arts and Entertainment Report profiles fans and enthusiasts of 52 sports, active recreation, arts or entertainment places/events. It also includes fan ratings for 16 major sports, the importance of sponsorship to fans and the star power of the Nations favourite sporting celebrities.

The methodology uses a combination of the Nielsen and BrandAdvantage Sports, Arts and Entertainment online survey conducted in May/June 2015 with a sample size of 2,500 and Nielsen’s Consumer and Media (CMI) service, an annual rolling survey with a sample of 12,000 New Zealanders.