Nothing illustrates Americans’ resilience quite like consumer spending. And after living alongside the novel coronavirus (COVID-19) for the past eight months, a majority of U.S. adults are ready to mask up, leave home and get back to a lifestyle that’s not hampered by crisis—albeit safely.

With so much information now available about ways to safeguard against infection, a consumer lifestyle survey conducted in October by Nielsen Audio found that 53% of Americans believe life is starting to normalize, they are more likely to resume typical activities and are starting to shop more as restrictions permit. That doesn’t mean, however, that these consumers are disregarding health and safety. The study also found that the people who are ready to get out also feel more confident about avoiding risk and staying safe when they leave their homes.

Consumer sentiment about resuming spending is in line with recent data from the U.S. Bureau of Economic Analysis (BEA), which indicated $201.4 billion in consumer spending growth in September. While consumer spending accounts for two-thirds of the country’s economic activity, it’s also a huge part of getting back to normal routines.

It’s worth noting that the more than $3 trillion in federal pandemic relief played a big role in driving this year’s third-quarter economic growth. Despite the depletion of that stimulus, the U.S. unemployment rate, as reported by the Bureau of Labor Statistics, has been trending downward since peaking at 14.7% in April. The most recent addition of 661,000 nonfarm jobs in September cut the unemployment rate to 7.9%.

Despite the recent rise in new COVID-19 cases in the U.S., consumer sentiment among Americans remains among the highest in the world, with second-quarter consumer confidence (as reported by the Conference Board) clocking in at an index level of 102 (2 index points above the baseline of 100). Combined with eased business restrictions across the country, the marginally optimistic mindset of consumers, a better understanding about how to stay healthy—and perhaps a dash of cabin fever—have influenced a majority of Americans to begin spending on non-essentials, including out-of-home dining, non-food retail and travel.

Notably, advertisers aren’t blind to the increased consumer spending, and many big advertisers have re-configured and jump-started their marketing efforts for life in the new normal. While many large advertisers benefit from being in health and e-commerce categories, such as P&G and Amazon, Digiday recently reported increased marketing initiatives from Volkswagen, Expedia and General Motors.

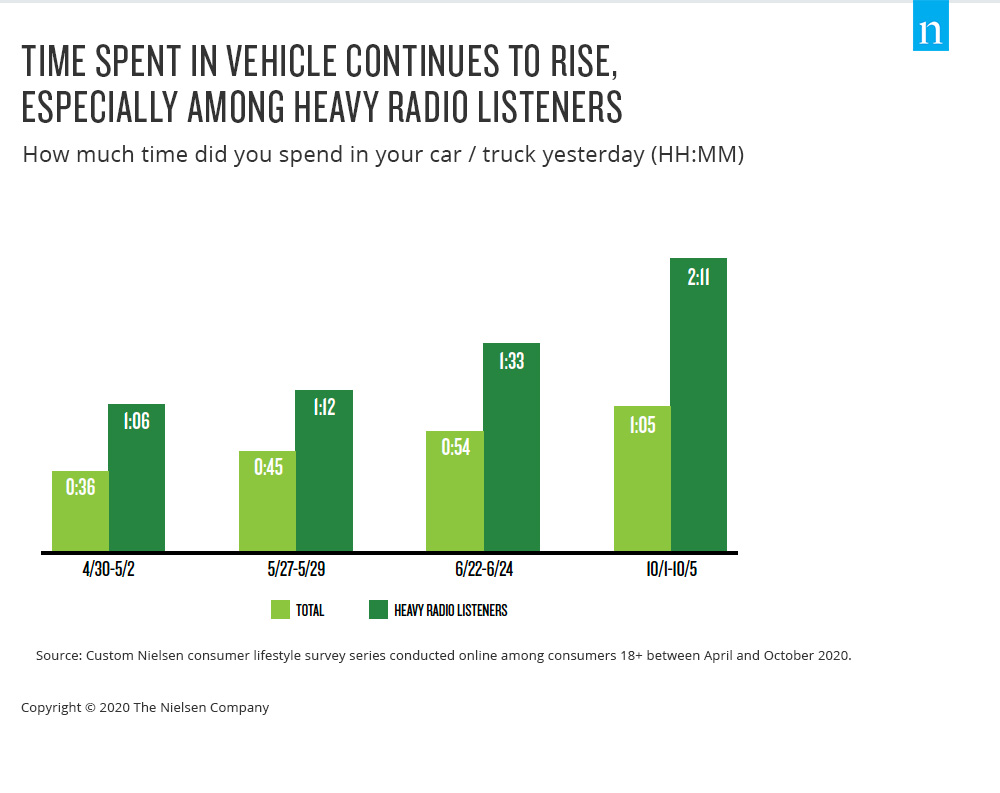

As these, and other, advertisers plan through the final two months of 2020 and into 2021, they will need to consider their prime audience—especially those more likely to spend on non-essentials. Importantly, that means understanding the best ways to reach these consumers. And despite everything that has taken place in 2020, the 53% of Americans who are ready to get back to their lives are heavy AM/FM radio listeners. They’re also a prime target audience for advertisers, as they are more likely to be between 25 and 54, have kids and earn more than $100,000 per year. They’re also more likely to work away from the home (thus the heavy radio listening). And contrary to what you’d expect when many people are staying close to home, heavy radio listeners have been actively driving (and listening) throughout the year. The time they’ve spent in their vehicles, however, has steadily risen since April.

In addition to listening to more radio than the average consumers, heavy radio listeners are far more likely to be planning to expand their non-essential expenditures. For example, they’re 48% more likely to make a major purchase, like an appliance, and they’re 45% more likely to visit a car or truck dealership. Vehicle purchases (and associated advertising) during a pandemic, while somewhat counter-intuitive, have started to rebound on the heels of what industry analysts are referring to as pandemic-induced demand. Research from McKinsey and Ipsos has found that consumers view private vehicles as safe spaces when compared with public transportation. Very low auto finance rates, along with savings due to reduced vacations and entertainment, are also encouraging new auto purchases.

Importantly, not all radio listening is happening away from the home. While almost 70% of radio listening between March and October happened away from the home, in-home tune-in remained steady—and perhaps higher than might be expected for a medium that many equate with commuting. Nielsen PPM data shows that in-home listening among people 18 and older ranged between 29% and 42% during that period. So the big takeaway here is that amid the many headlines about the shift to streaming, radio—and its listeners—represent America’s resilience and a desire to move forward.

For additional information, download our recent On the Road to Recovery with AM/FM Radio report.