Recent economic conditions have encouraged American consumers to spend carefully across entertainment categories, and gaming has been no exception. Public data shows that game sales at retail decreased slightly in 2010, and, according to Nielsen’s recently released 360° Gaming Report, so did gaming’s share of entertainment spending per household. These decreases took place even as household leisure budgets increased by 9 percent from 2009 among video game buying homes*. So, where did video gaming’s share of spending go?

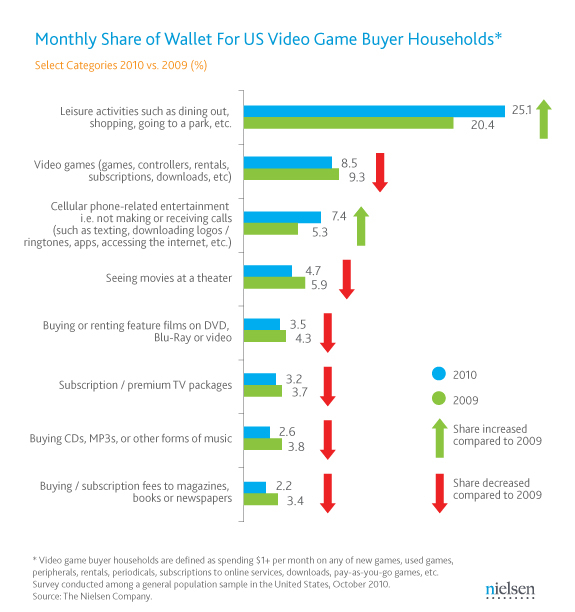

It appears that while overall leisure budgets increased year-over-year, not all media and entertainment categories benefited equally. Out of home activities (such as dining out) and cell phone-related entertainment saw gains, but at the expense of video games and other forms of entertainment. While the share of the leisure budget dedicated to video games decreased slightly, the number of actual dollars reportedly spent on video games was nearly even in 2010 versus 2009. Amidst a rising tide in overall leisure spending, standing still or losing dollars added up to a smaller share of wallet for video games, movie-going, DVDs / Blu-rays, music and print media.

Shift in Budget… or Screen?

How do we explain the growth in spending on out-of-home activities and cell phone-related entertainment? The first is a likely barometer of improving overall consumer confidence while the second may reflect a broader shift toward mobile in how consumers invest their media and entertainment dollars. Given the popularity of games as a paid form of content on mobile devices (Angry Birds, etc.), it stands to reason that some of the spending traditionally earmarked for non-mobile video games shifted to cell phone-related entertainment but is likely still within the gaming umbrella. The same logic may apply to the other categories that experienced slight declines in share. The screen is shifting but the content may be the same.

Video game buyer households account for 26 percent of U.S. homes, roughly even with 24 percent in 2009.The chart shows share of monthly leisure spending among them for the biggest shifting categories in 2010 versus 2009. Despite the proportionally smaller investment in gaming in 2010, the category still earned a larger slice of entertainment spending among these households than other TV-based entertainment options, including subscribing to premium TV packages and DVD / Blu-ray related-spending. In addition, this data was collected before the holiday season was over and thus may not be a harbinger of things to come as momentum builds from Kinect’s successful launch in November and as a strong slate of releases becomes available to potential buyers this spring.

The lack of consistency in shifts across categories suggests this is a trend to watch. In theory, a change in overall leisure spending, up or down, need not have any impact on share devoted to each category but it clearly did in 2010 versus 2009. Some of this can be attributed to cyclical sentiment and behavior shifts during a recessionary period. However, a deeper look suggests structural changes across media and entertainment, such as the rise in mobile spending will continue an elaborate tug-of-war among screens and categories for share of wallet.

For the past two years Nielsen has interviewed more than 3,000 US consumers to gain insight into entertainment choices through the lens of gaming. Complete data and analysis on share of wallet across all categories as well as other findings on gaming can be found in the full 360° Gaming Report. Join us for the webinar U.S. Gaming: A 360° View, on March 16th covering the state of the U.S. video game industry.