When it comes to children’s book buyers, purchasing habits are not homogenous. Just like elsewhere across the consumer product landscape, not all consumers in this category are created equal. Said another way, some book buyers present publishers and retailers with more opportunity than others.

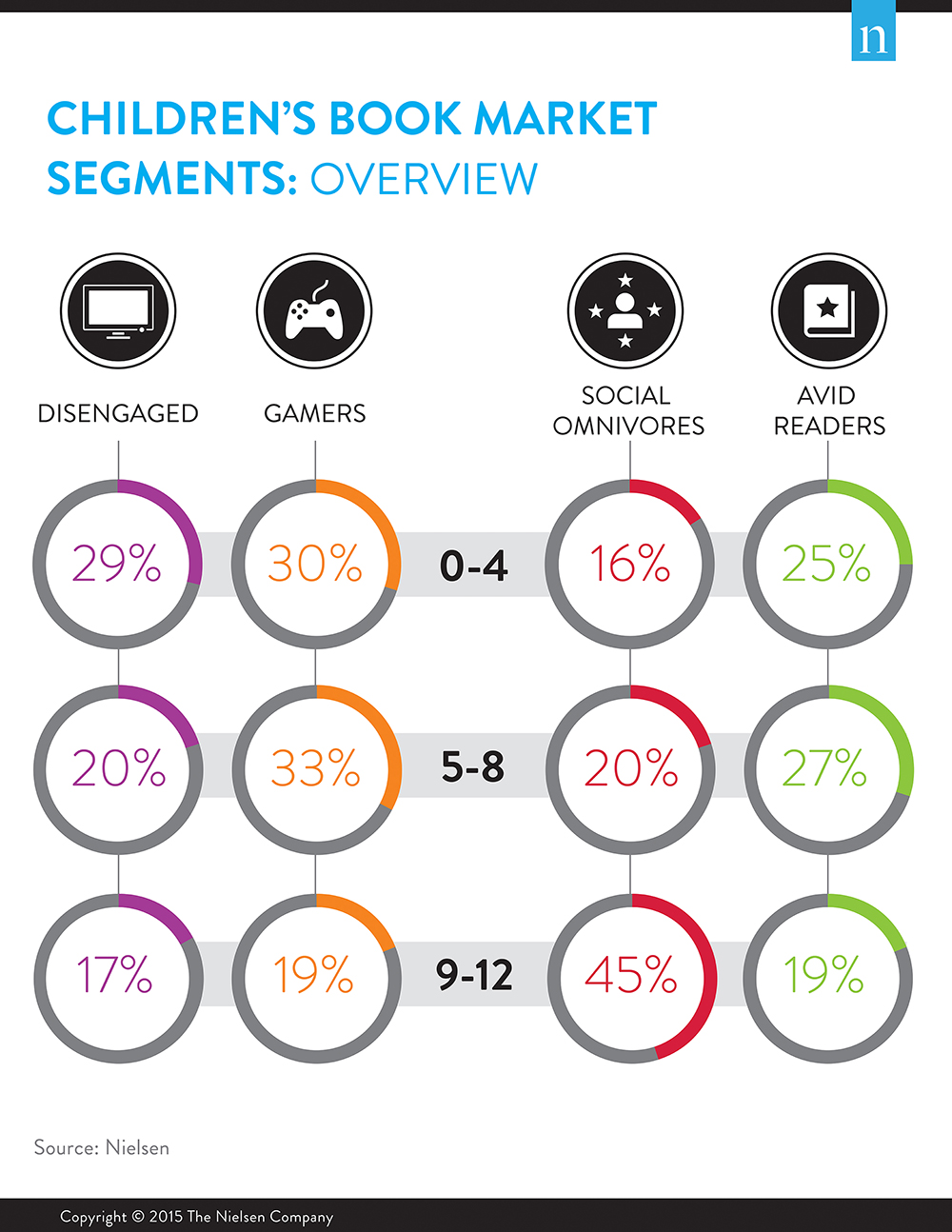

To better understand consumption in the children’s book market, Nielsen recently conducted a segmentation study that identified four distinct types of children’s book buyers in the U.S.:

- The Disengaged: While this group does value books, they are not “reading households” to the same extent as other segments and are not as heavily invested in most other leisure activities.

- The Gamers: Gamer parents are digital natives, although they do buy children’s books for children 0-4 for educational purposes. This group likes video games—both on and offline—more than books at all ages.

- The Social Omnivores: This group is involved in everything. They place high value on books, new media, old media and fun and games. And they like talking about these activities.

- The Avid Readers: This is the core audience for publishers at all ages. These consumers love reading and are the heaviest buyers and borrowers of books.

Of the four groups the study identified, two represent real opportunity for publishers: Social Omnivores and Avid Readers.

For the study, Nielsen surveyed 3,000 families with children in three age bands:

- 0-4 year olds, when parental influence on reading is high for children.

- 5-8 year olds, when children are beginning to make independent reading choices, but their parents are still influential.

- 9-12 year olds, when children are much more in control of their own reading choices.

The segmentation study generated the first comprehensive look at which consumers in the children’s book market are most valuable to publishers and which buyers represent the best opportunities for growth.

Book-buying families with children 5-8 years old are especially important for publishers because children in this age range wield tremendous economic power. While they don’t have wallets or paychecks yet, they are very vocal when it comes to asking their parents for specific books and series. In fact, “My child asked for it” is the top reason parents in book-buying households make their purchases.

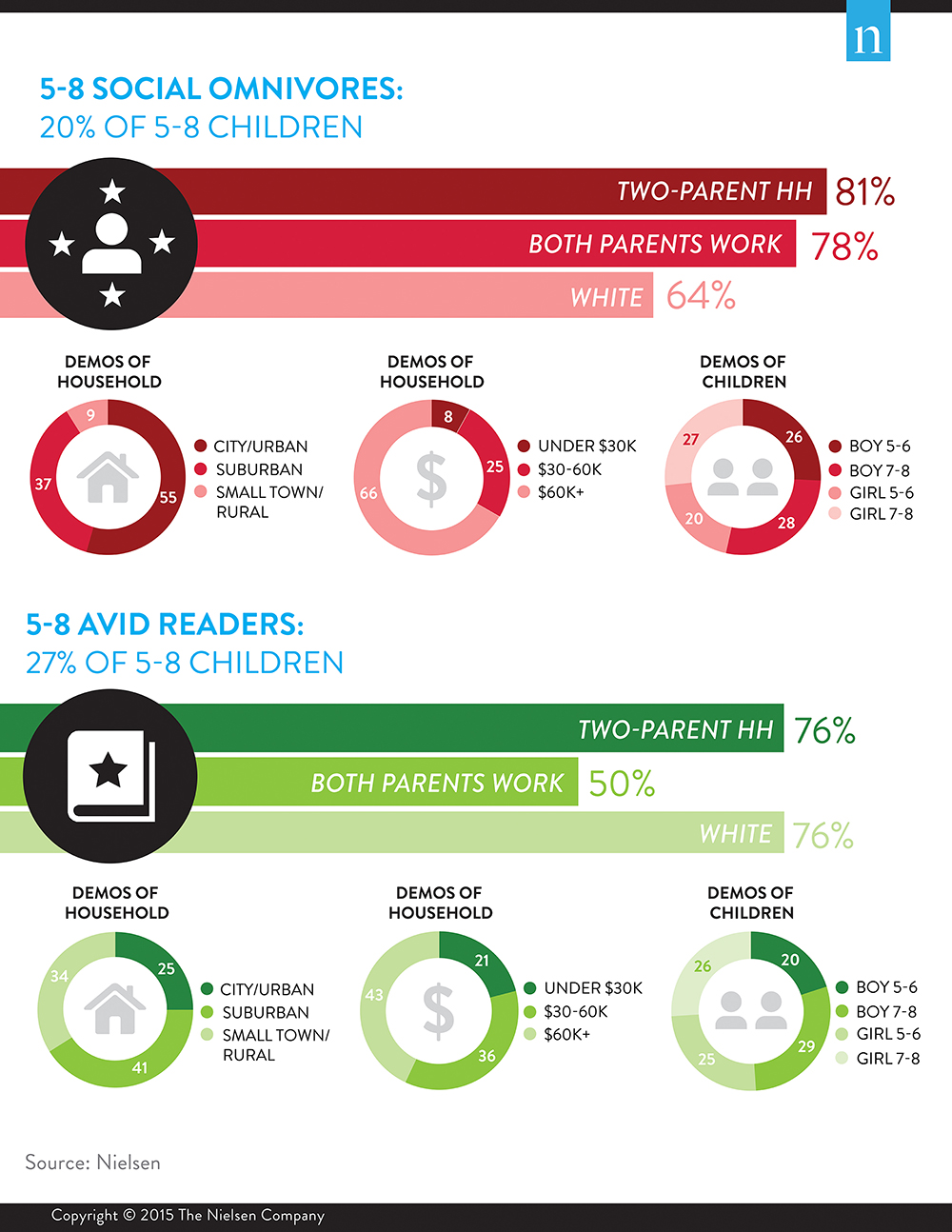

According to the research, the Avid Reader is the publishing industry’s sweet spot. This group represents no more than 27% of children 5-8 years old, but accounts for 41% of the book buying and 71% of the book borrowing in families with children in this age range. In the last six months, Avid Reader families have bought nine books and borrowed 20 books. In addition, an Avid Reader family buys two out of every five books bought for a child 5-8. But Social Omnivore families are active buyers as well, as they’ve bought four books and borrowed seven books for a child 5-8 years old in the last six months.

While Social Omnivores account for the smallest proportion of the very youngest group (16%; see chart 1), they account for nearly half (45%) of all 9-12 year olds. After Avid Readers, Social Omnivore households buy the most books, and given their segment size and behavior, represent the best opportunity for growth to publishers. So how do the two groups compare?

Social Omnivore families are more likely to have two parents in the household, and are more likely to have both parents working than Avid Reader families. They’re also 30% more likely than Avid Reader families to live in a city, and they’re more likely to be non-white. Social Omnivore families are more likely to have a higher household income than their Avid Reader counterparts.

So how can publishers’ reach their most valuable consumers?

For all segments, the top three purchase triggers, given by about half of all parents are:

- Seeing the book on the shelf

- The (cheap) price

- An impulse purchase in the store

Looking more closely, Avid Readers are more likely to be influenced by shelf displays and sale prices.

Looking to the future, publishers who want to grow their businesses should focus on three key tactics:

- Embracing multicultural characters and content;

- Mastering multichannel marketing; and

- Understanding the kinds of values-based decisions that both Avid Reader and Social Omnivore families make, as well as the differences between them.

The complete report is available for purchase in our e-store.

METHODOLOGY

Nielsen’s Who Buys Children’s Books and Why: Understanding The Most Valuable Us Children’s Book Consumers 2015 report is the first segmentation study to comprehensively examine the different types of buying families in the U.S. children’s book market. The goal of the study was to define the attitudes, drivers, behaviors and demographic profiles of children’s book consumers in the U.S., and to identify those consumers who represent the most valuable current and future customers. The study included 3,000 book-buying families in total, divided into 1,000 families each of children ages 0-4, 5-8 and 9-12. The report includes detailed demographic reporting on each of the four identified segments across each of the age groups, including household demographics, parental activities and attitudes, child activities and attitudes, book buying behaviors and channels, as well as genre preferences.