Never in the history of television have audiences had the breadth of choice that they have today. While that’s not news to anyone, the extreme volume of content has a tendency to overshadow its long-term value, especially when all eyes are typically focused on the latest hit to land on any of the big streaming services.

The most recent streaming hit Suits, however, is anything but typical. It’s also not an original. And while the incredible viewership it has attracted speaks to the enduring attraction of acquired content, this title is effectively indistinguishable from an original because of the large audience that it’s attracting.

Yes, viewership for Suits has been staggering—as well as newsworthy. And in addition to attracting a different audience from when it was on USA Network, Suits is timely—given that it ended its run on basic cable in 2019—which is somewhat unique from other popular acquired programs like Seinfeld, The Office and Friends. The show also originally aired at a time when cord-cutting was well underway, possibly hiding it from streaming-first audiences.

Capturing the attention of an audience is a powerful thing, and there is incredible value in that. Among the more than 10 hours that Americans spend with media1 each day, TV commands the biggest share: half the total. And as the industry is well aware, audiences continue to gravitate to streaming services. In July of this year, audiences spent a record 38.7% of their TV time with streaming content.

The media industry has always understood the value of content, but few of us could have imagined how sprawling and fragmented the TV landscape would become—or even how the definition of TV would change. Today, the audience has all the control, combined with all the choice. And while there’s no mistaking the value of what they spend their time watching, U.S. audiences now have more than 31,500 different channels and streaming sources2 to find content on. That is a massive shift from aggregated grids of scheduled, provider-chosen options.

This complexity magnifies the importance of the core tenet of modern media measurement: exposure. At face value, understanding who’s watching, for how long and how often provides a baseline for program and channel performance. But as the landscape fragments and choice increases, that baseline needs to be universally applicable and interoperable.

Viewing data for the CBS drama S.W.A.T. tells us, for example, that the show is a favorite among streaming audiences, as they watched 891 million minutes3 of the drama during the week of June 26—making it the fourth most-streamed show of that week. For content creators and distributors, this data validates the popularity of the program.

But as individual programs and movies become available across multiple services, individual channels need to understand their share of the total audience. In the case of S.W.A.T., viewership during the week of June 26 was spread across three different platforms: Hulu, Netflix and Paramount+. This is where comparable, consistent and deduplicated metrics provide the industry with unprecedented visibility into viewership wherever it happens. This is the promise of Nielsen One.

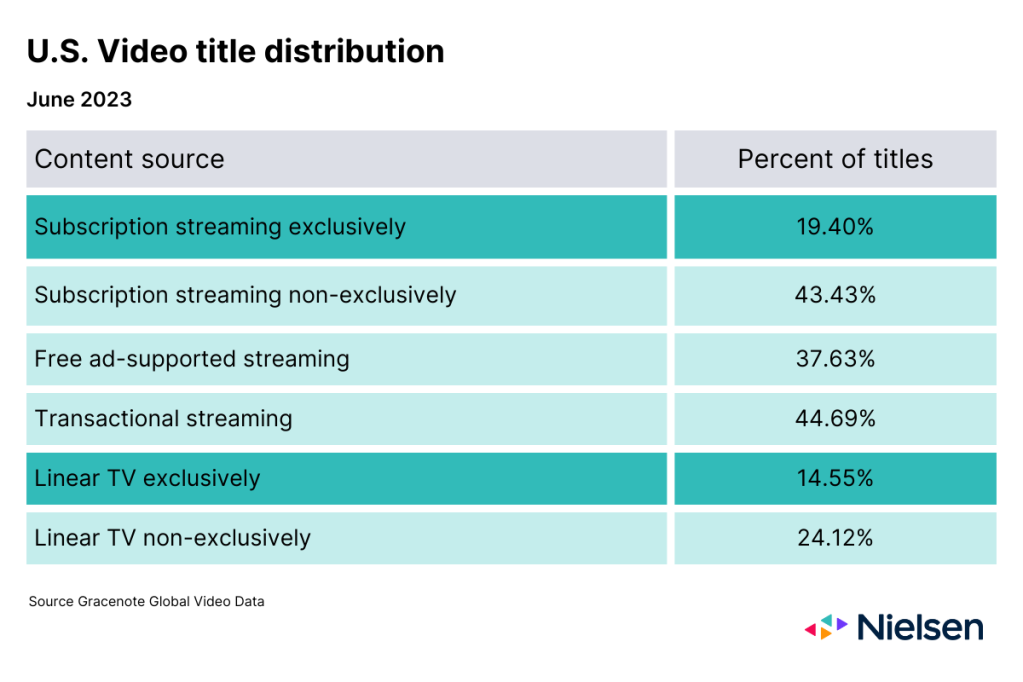

That visibility will become increasingly more critical as streaming content libraries grow and individual titles span multiple services and platforms. In June of this year, 84% of the more than 1 million video titles4 available to U.S. audiences were available on streaming platforms. And what’s more, very little video content today is exclusive to a specific channel or service.

While Suits is a clear stand-out, its popularity highlights the enduring longevity of content—something that streaming is evolving to capitalize on. The three free ad-supported television (FAST) channels that are independently measured in The Gauge, for example, had grown to account for 3.4% of total TV usage in July5, and FAST channels are almost exclusively built with acquired content.

This rise of FAST channels isn’t an experiment in streaming audience engagement. In May 2023, acquired content accounted for 60% of streaming viewing6. This trend also holds true among young viewers. Last year, for example, 18 of the 25 most-streamed programs by women 18-34 originally aired on traditional networks years before. And this audience streamed just under 77 billion minutes of these shows, with titles like Grey’s Anatomy and Gilmore Girls easily outpacing Stranger Things.

What does all of this tell us? As the TV landscape transforms, the industry is just starting to understand the value of its vast supply of content. No one knows audiences like Nielsen does, and the nuances of today’s TV landscape are what we look forward to exploring, with our partners, every day.

Sources:

1National TV Panel, Q1 2023

2Gracenote Global Video Data, June 2023; each channel represents a unique source of linear programming and each streaming video source represents an individual streaming provider

3Nielsen Streaming Content Ratings, Nielsen National TV Panel, U.S. viewing through television

4Gracenote Global Video Data

5The Gauge, July 2023

6Streaming Content Ratings