CONTACTS:

Marisa Grimes, +1 646 654 5759, marisa.grimes@nielsen.com

Alessandra Rossi, +31 20 398 8213, alessandra.rossi@nielsen.com

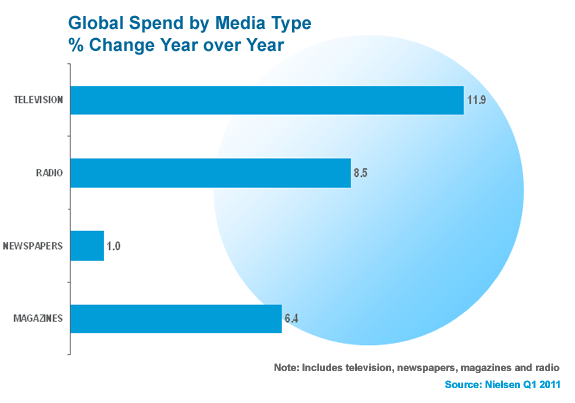

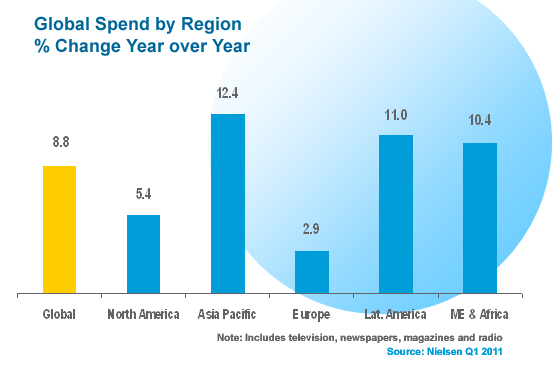

New York, NY – (July 5, 2011) – Global advertising rose 8.8 percent year-on-year in Q1 to total USD 118 billion based on published rate cards, as advertisers spent more on television and continued to invest in booming consumer Asian and Latin American markets. According to the new Nielsen Global AdView Pulse report, television advertising rose 11.9 percent year-on-year and increased its share among other traditional media (radio, magazines, and newspapers) from 63.5 percent to 65.3 percent in both developed and many emerging economies.

“With USD 6.50 of every ten dollars being spent on television, it’s clear that TV remains the most important and cost effective advertising medium for companies looking to reach new consumers, especially in booming emerging markets,” said Randall Beard, Global Head of Advertiser Solutions for Nielsen. “In fact, according to two Nielsen reports released last month, women globally said they preferred to find out information on new products and services via television more than any other medium, and the Q1 Nielsen Cross-Platform Report showed that Americans are watching more TV than ever before.”

Advertising in the world’s largest market, USA, rose 5.9 percent to reach nearly USD 27 billion in Q1 with stable increases for TV, radio and magazines; however, newspaper advertising dropped by more than 10 percent in another blow to the domestic newsprint industry. Newspaper advertising also declined -1.6 percent in Western Europe in Q1.

Emerging regions of Asia-Pacific (+12.4%) and Latin America (+11%) drove global ad growth in Q1, followed by Middle East/Africa which still increased 10.4 percent despite a 51.3 percent decline in Egypt’s ad revenue as most companies temporarily halted advertising during the country’s social and political upheaval. Western Europe posted the lowest growth rate of all global regions in Q1 of 2.9 percent as the region’s divergent economic performance sent ad spend in Greece, Ireland, Italy and Spain into negative territory – in contrast to double-digit growth in Europe’s more robust markets of Turkey (+12.9%), France (11.6%), and Norway (+10.2%).

Argentina (+37%) and South Africa (+34.8%) posted the highest year-on-year gains, while other emerging markets of China, India, Indonesia, Malaysia, Philippines and Saudi Arabia had double-digit gains in Q1.

Methodology

The external data sources for the other countries included in the report are:

- Argentina: IBOPE

- Brazil: IBOPE

- Egypt: PARC (Pan Arab Research Centre)

- France: Yacast

- Greece: Media Services

- Hong Kong: admanGo

- India: Nielsen in association with TAMIndia

- Japan: Nihon Daily Tsushinsha

- Kuwait: PARC (Pan Arab Research Centre)

- Lebanon: PARC (Pan Arab Research Centre)

- Mexico: IBOPE

- Pan-Arab Media: PARC (Pan Arab Research Centre)

- Portugal: Mediamonitor

- Saudi Arabia: PARC (Pan Arab Research Centre)

- Spain: Arce Media

- Switzerland: Nielsen in association with Media Focus

- UAE: PARC (Pan Arab Research Centre)

About Nielsen

Nielsen Holdings N.V. (NYSE: NLSN) is a global information and measurement company with leading market positions in marketing and consumer information, television and other media measurement, online intelligence, mobile measurement, trade shows and related properties. Nielsen has a presence in approximately 100 countries, with headquarters in New York, USA and Diemen, the Netherlands. For more information, please visit www.nielsen.com.