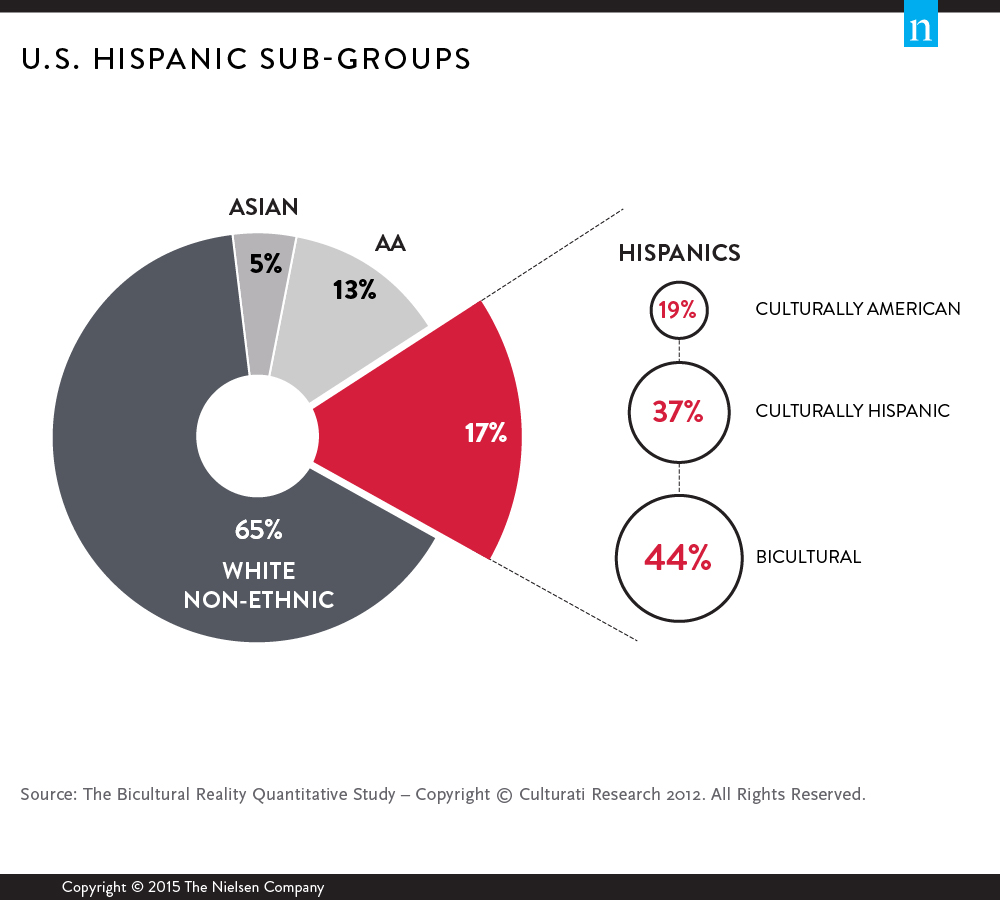

A question for marketers who have embraced a focused Hispanic strategy: Is the Hispanic-bicultural consumer on your radar? If not, they should be. With the Hispanic-bicultural sub-group accounting for 44% of the Hispanic population in the U.S. and representing 45% of total U.S. Hispanic buying power, insights into this consumer subgroup can be crucial for campaign success.

Bicultural identity is the condition of being oneself with the ability to function within two cultures and embrace the best of both worlds. Bicultural consumers are a unique segment in today’s diverse market. It is essential to understand the dynamics of biculturalism and its effect on consumer and shopper behavior to help maximize Hispanic marketing investments.

There is great value and opportunity in identifying Hispanic consumers beyond just language and demographic data. Nielsen and Culturati together are breaking new ground and setting the stage for a new way to view and measure the Hispanic consumer. With the recent launch of the Nielsen-Culturati Hispanic Panel Segmentation, marketers will now be able to track brand results by bicultural and other key Hispanic segments and identify key growth opportunities. This new collaboration combines the power of Nielsen’s household panel data with an in-depth understanding of Culturati’s attitudes and values-based U.S. Hispanic segmentation model.

What’s exciting is that the breadth of Hispanic consumer measurement can now be extended beyond just language and demographics to incorporate important factors such as attitudes and values—uncovering the motivation behind shopper and consumer behavior. This model is designed to help brands calibrate their messaging and marketing strategies for greater relevancy.

“This new segmentation can be an important tool for our clients trying to appeal to Hispanic consumers since distinctions and nuances between each subsegment of the Hispanic consumer market are revealed,” said Monica Gil, SVP and General Manager of Multicultural Growth and Strategy at Nielsen. “With this, marketers will be able to maximize their Hispanic marketing investments by developing the right marketing plans, in-store programs and communications strategies.”

With the Nielsen’s Hispanic Household Panel, four key attitude-based segments will be used to help marketers gain a deeper understanding of today’s U.S. Hispanic reality. These four segments include:

- Latinistas (culturally Hispanic) who are very traditional and Hispanic-centered, as well as the least focused on blending cultures. One-third of Latinistas are second and third generation and more than half prefer to speak Spanish but can use English if needed.

- Heritage Keepers (bicultural) who, while somewhat progressive, are Hispanic-centered and focused on preserving their heritage. Most (86%) Heritage Keepers are first generation Hispanics and prefer to speak in Spanish.

- Savvy Blenders (bicultural) who are very progressive, embrace diversity and are focused both on preserving their heritage and blending cultures. Savvy Blenders are bilingual and their language preference is highly situational. While this segment has a strong second generation population at 49%, it is quite diverse with first generation accounting for 29% and third generation accounting for 22% of the segment.

- Ameri-Fans (culturally American) who are progressive with a diluted Hispanic heritage, and are closest to the average mainstream consumer. The majority (82%) is second or third generation and prefers to speak in English.

“What makes this segmentation model unique and more actionable is that it is based on attitudes and values, not just on language and demographics,” said Culturati’s President, Marissa-Romero Martin. “With this, marketers are able to garner insights that more accurately reflect the reality of the U.S. Hispanic market. This is valuable knowledge for brands that recognize that Latinos are no longer a subset of the market, but a significant player in the consumer space. Connecting with Hispanic audiences is critical for all brands if they want to grow over the next decade.”